Los Angeles Measure ULA, officially known as the “Homelessness and Housing Solutions Tax,” is a ballot measure that Los Angeles voters approved in the 2022 midterm elections. Measure ULA has also been referred to as a “mansion tax,” as it affects real estate valued at $5 million or more, and it affects both residential and commercial real estate transactions in the City of Los Angeles.

Measure ULA AT A GLANCE:

- Properties valued between $5 million and $10 million will be subject to a transfer tax rate of 4.0% of the sales price.

- Properties valued $10 million or more will be subject to a transfer tax rate of 5.5% of the sales price.

- The HHS tax is a transfer tax, meaning that it applies when a property is sold/transferred to a new owner.

- The tax is in addition to the existing 0.56% documentary transfer taxes currently imposed by the City and County of Los Angeles.

- The $5 million and $10 million valuation thresholds will be adjusted each year based on inflation.

- Measure ULA is scheduled to take effect on April 1, 2023, and the new tax will apply to property transfers on or after that date.

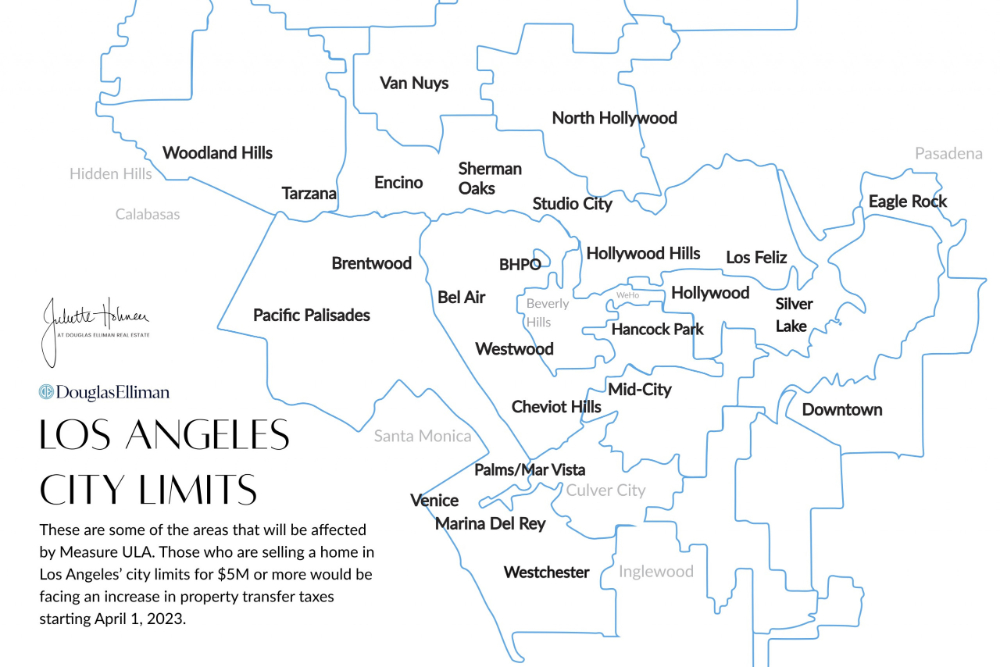

- Measure ULA applies to properties within the City of Los Angeles, but it does not apply to the 87 incorporated cities within LA, such as Beverly Hills, Santa Monica, Culver City, West Hollywood, Pasadena, and Long Beach.

- The revenue generated (an estimated $600 million to $1 billion) from the tax will be allocated to programs that fund affordable housing, provide resources to at-risk tenants, and address homelessness issues.

HOW WILL MEASURE ULA AFFECT THE REAL ESTATE MARKET?

As a transfer tax, this new tax will be the sellers’ responsibility to pay. However, sellers will undoubtedly try to pass at least some of this tax on to buyers in the form of higher sales prices. That is, sellers will want a higher sales price to cover the added cost of the new tax. But whether buyers will be willing to pay these higher sales prices is another issue entirely. Looking at data from the MLS for Greater Los Angeles, there is already an oversupply of single family homes on the market in the $5 million and up range. As of December 2022, there is a 15 months’ supply of homes priced $5 million and over (compared to the 3 months’ supply of homes priced under $5 million). Clearly, with so much inventory to choose from, it is a buyer’s market in the $5+ million range, and sellers may not be able to pass along their tax increase to buyers.Sellers could also try to negotiate that buyers contribute to the HHS transfer tax as part of the contract, but unless the buyer is purchasing all-cash, there may be lending limits to how much cash buyers can contribute.Some sellers may try to sell in the first quarter of 2023 to avoid having to pay the HHS tax, but this could result in an even greater supply of listings in the $5 million and up market, which could mean that prices have to come down to entice buyers, who are also dealing with the higher interest rates. Sellers may also choose to sell for less than they would have otherwise, just to avoid meeting the $5 and $10 million thresholds.An unintended consequence of Measure ULA is that it could result in less housing being built overall. The 4.0% and 5.5% tax increase is going to eat into the profit margins of developers and builders. If developers can’t pass the cost of the tax on to buyers, they may decide not to build at all. And in the case of developers of rental properties both residential and commercial, they will need to charge higher rents to tenants in order for a new project to be financially viable. While proponents of Measure ULA claim that it won’t increase rents for commercial and residential tenants, it’s hard to see how higher costs for developers are not eventually pushed on to renters in the form of higher rents.In the short term, developers may choose to build in other cities or states not subject to the HHS tax. Again, this could mean less new housing in Los Angeles, and whether it is new luxury homes or new affordable housing, what LA needs desperately is new housing. The other incorporated cities in LA may see more building as developers flock to these areas to avoid the tax.

We could see some creative work-arounds that aim to avoid the tax, such as a land leases deal where the seller sells the improvement (i.e. the building) but leases the land to the new buyer. There could also be deals where sellers try to sell the land and the improvement in separate transactions to avoid hitting the tax thresholds. We may also see homeowners taking out a second mortgage to buy a cheaper property to live in, then renting out their $5+ million home.One big question that remains to be answered is whether this new HHS tax will be triggered when there is a transfer of interest in legal entities that result in a change of ownership. Measure ULA grants the City’s Director of Finance the authority to define “realty sold,” which will define how and when the tax will be triggered.

David Siddons, an expert Miami real estate agent, Mark Cohen, one of the best mortgage brokers in L.A and I discuss Measure ULA further on my podcast, The Juliette Interviews. Listen in for 2023 predications, reasons to invest in Miami and more here (also available on YouTube and Apple podcasts).