The Santa Monica real estate market entering February 2026 is defined by a shift toward stability and increased buyer leverage. While it remains a seller’s market due to chronic scarcity, the “frenzy” of previous years has cooled into a more disciplined environment. For those wondering if now is the right time to buy, the answer depends heavily on your timeline and whether you value turnkey perfection over a potential “deal.”

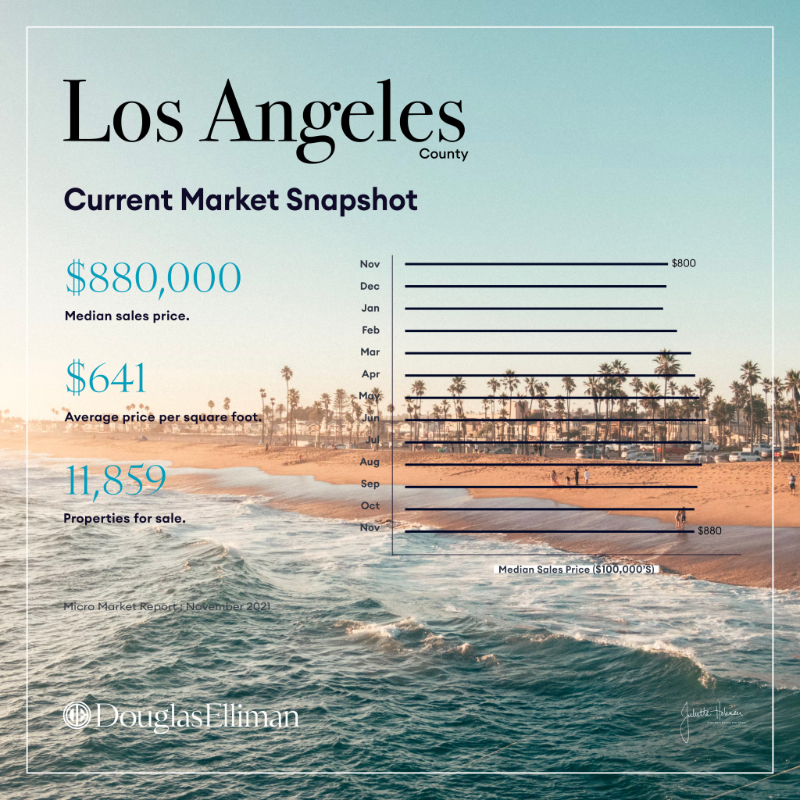

The Current Market Snapshot (January–February 2026)

As of January 2026, the median list price in Santa Monica sits at $1,825,000, down from $1,915,000 at the start of 2025. While prices in some luxury coastal pockets remain sky-high, the broader city is seeing a slight softening in valuations and a significant increase in the time it takes to sell a home.

-

Median Sale Price: ~$1,825,000 (down roughly 4.7% year-over-year).

-

Days on Market: Properties are averaging 68 days on the market, compared to 46 days at this time last year.

-

Inventory Trends: Active listings are currently around 300, though some specific neighborhoods like 90405 (Ocean Park) have seen inventory drops as high as 22% in early Q1.

Mortgage Rates: The Sub-6% Threshold

One of the strongest arguments for buying now is the relative stabilization of mortgage rates. After peaking near 7% in 2025, rates have moderated.

-

30-Year Fixed Rate: Averaging 5.99% to 6.11%

as of February 9, 2026. -

15-Year Fixed Rate: Averaging approximately 5.37% to 5.55%.

Experts predict rates will hover between 5.5% and 6.0% for much of 2026. While not the “pandemic lows” many were hoping for, this consistency allows buyers to budget with more certainty.

The “Honest” Analysis: Pros and Cons

Why it’s a GOOD time to buy:

-

Buyer Leverage: Nearly 50.5% of homes in late 2025 sold under list price. Buyers are successfully negotiating for inspections and repairs, a rarity two years ago.

-

The “Great Reset”: Economists note a “Correction in Expectations.” Sellers have largely accepted that demand is slower, leading to more realistic initial pricing.

-

Stability of Assets: In core coastal communities like North of Montana, scarcity keeps prices stable even when the broader LA market fluctuates.

Why you might want to WAIT:

-

The “Picky” Market: If you aren’t looking for a “turnkey” home, you may find yourself sitting on the sidelines. Buyers are currently extremely selective, paying premiums for “perfection” while allowing outdated homes to sit for months.

-

Economic Headwinds: California’s job market, particularly in the entertainment and tech sectors, saw significant contraction in late 2025, which may weigh on local demand through mid-2026.

Neighborhood Spotlight

-

North of Montana: Remains the gold standard for stability. Scarcity here is absolute, and high-end estates still move quickly.

-

Ocean Park: Seeing a drop in inventory but high demand from walkability-focused buyers near Main Street.

-

Condo Market: Generally seeing more softening than single-family homes, offering the best entry points for first-time buyers.