Trump’s new tax rules makes it extremely advantageous to own rental properties. One Big Beautiful Bill Act (OBBBA), has created a major tax incentive: 100% bonus depreciation.

Here’s what that means:

Starting January 20, 2025, investors can take advantage of 100% bonus depreciation for qualifying properties placed in service. That’s a huge opportunity to deduct a significant portion of your investment in the first year, reducing your taxable income and maximizing your return.

Quick breakdown:

• Before Jan 20, 2025: 40% bonus depreciation

• On or after Jan 20, 2025: 100% bonus depreciation is restored, permanently

• This allows for an immediate write-off of qualifying improvements and equipment

What qualifies?

Most tangible property with a recovery period of 20 years or less. That includes things like appliances, flooring, HVAC systems, and even used equipment (as long as it’s new to you).

Bonus depreciation is claimed on IRS Form 4562, so be sure to check in with your CPA to see how this could impact your investment strategy.

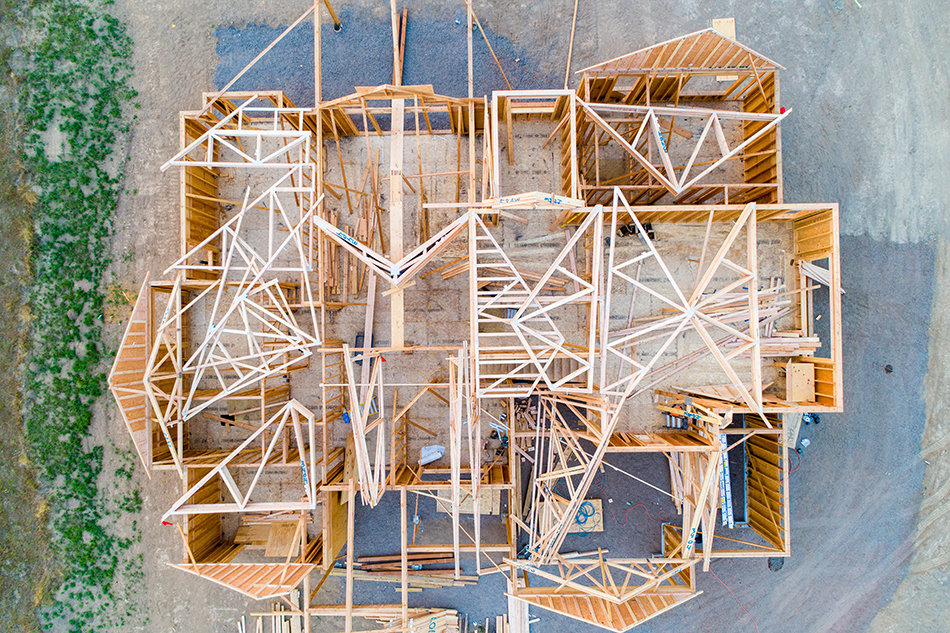

Our Picks for the Perfect Rental?

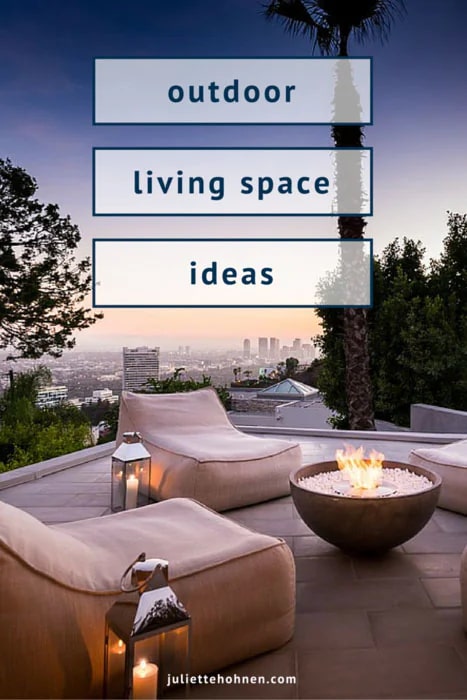

2020 Coldwater Canyon

This stunning property checks every box for a high-performing rental, here’s why:

• Prime location in Beverly Hills Post Office

• Perfect setup for long-term, mid-term, or even a short term rental property

• High rental demand in the area

• Eligible for cost segregation, allowing you to maximize depreciation benefits even further

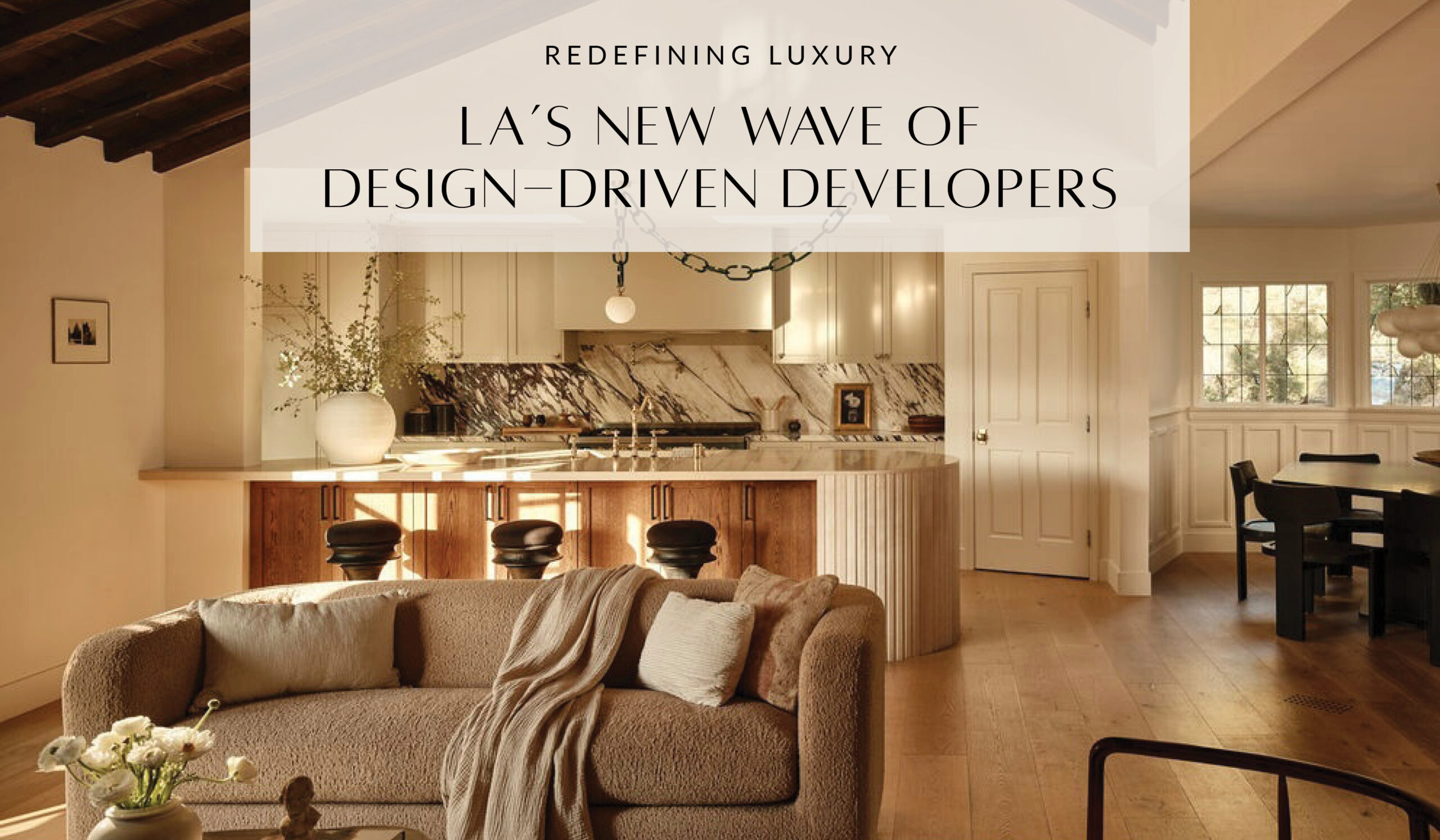

714 N Genesee

Another strong contender with potential:

• Great layout for renters

• Located in a highly desirable neighborhood

• Stylish features that keep vacancy low and rental rates high

• Qualifies for 100% bonus depreciation

Bottom line:

Smart investors know that timing matters, and 2025 is shaping up to be an incredible window to invest in real estate. With 100% bonus depreciation back in place and standout properties like 2020 Coldwater and 1449 Queens Way available, it’s the perfect time to take the leap.

Want to run the numbers or schedule a private showing? Let’s connect.

Resources

-

White House – One Big Beautiful Bill Act confirms the reinstatement of “100% immediate expensing” for business investments placed in service after January 19, 2025 Read Here

-

RSM US Insights states the OBBBA “makes permanent 100% bonus depreciation for most property acquired after Jan 19, 2025” Read Here

-

Tax Foundation explains that the bill “permanently restore[s] 100 percent bonus depreciation” for short-lived assets Read Here

-

Kiplinger outlines that the bill “makes the 2017 Tax Cuts and Jobs Act permanent…including accelerated depreciation” Read Here

-

The Week maps out “8 ways Trump’s bill will change your taxes,” including that bonus depreciation was at 40% but now restored permanently Read Here